UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for use of the Commission only (as permitted by Rule 14a-6 (e)(2))

þ Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material under Rule 14a-12

ARK RESTAURANTS CORP.

(Name of Registrant as Specified In Its Charter)

Same

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

o Fee previously paid with the preliminary materials:

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

| | |

ARK RESTAURANTS CORP. |

| 85 Fifth Avenue |

| New York, New York 10003 |

|

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS |

|

To Be Held on March 16, 202112, 2024 |

|

| To the Shareholders of |

| ARK RESTAURANTS CORP. |

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of Ark Restaurants Corp. (the “Company”) will be held virtually on March 16, 202112, 2024 at 10:00 A.M., New York City time. Due to the public health impact of the coronavirus pandemic (COVID-19), the protocols and guidelines that federal, state and local governments have imposed or recommended, and to support the health and well-being of our shareholders, employees and their families, this year’s Annual Meeting will be held in a virtual-meeting format only via live webcast. You may attend the Annual Meeting virtually via the Internet by accessing www.virtualshareholdermeeting.com/ARKR2021, where you will find instructions on how to register, vote electronically and submit questions. For additional instructions on how to attend the Annual Meeting, please review the accompanying proxy statement.

time, at Bryant Park Grill, located at 25 West 40th Street, New York, New York. At the Annual Meeting, you will be asked to consider and vote upon:

| | | | | | | | |

| (1) | To elect a board of nine directors;eight directors identified as standing for election in the accompanying proxy statement, each to serve until the 2025 Annual Meeting of Shareholders and until their successors are duly elected; |

| | |

| (2) | To ratify the appointment of CohnReznick LLP (“Cohn”), as our independent auditorsregistered public accounting firm for the 20212024 fiscal year; |

| | |

| (3) | To hold an advisory vote on a non-binding advisory resolution to approve the compensation or our named executive compensation;officers; and |

| | |

| (4) | To hold an advisory vote on the frequency of the advisory vote on executive compensation; and |

| | |

| (5) | To transact such other business as may properly come before the meeting2024 Annual Meeting of Shareholders, and any adjournment or any adjournmentspostponement thereof. |

The Board of Directors has fixed the close of business on January 25, 2021,16, 2024 as the record date for the determination of shareholders entitled to notice of, and to vote at, the meeting. All shareholders are cordially invited to attend.

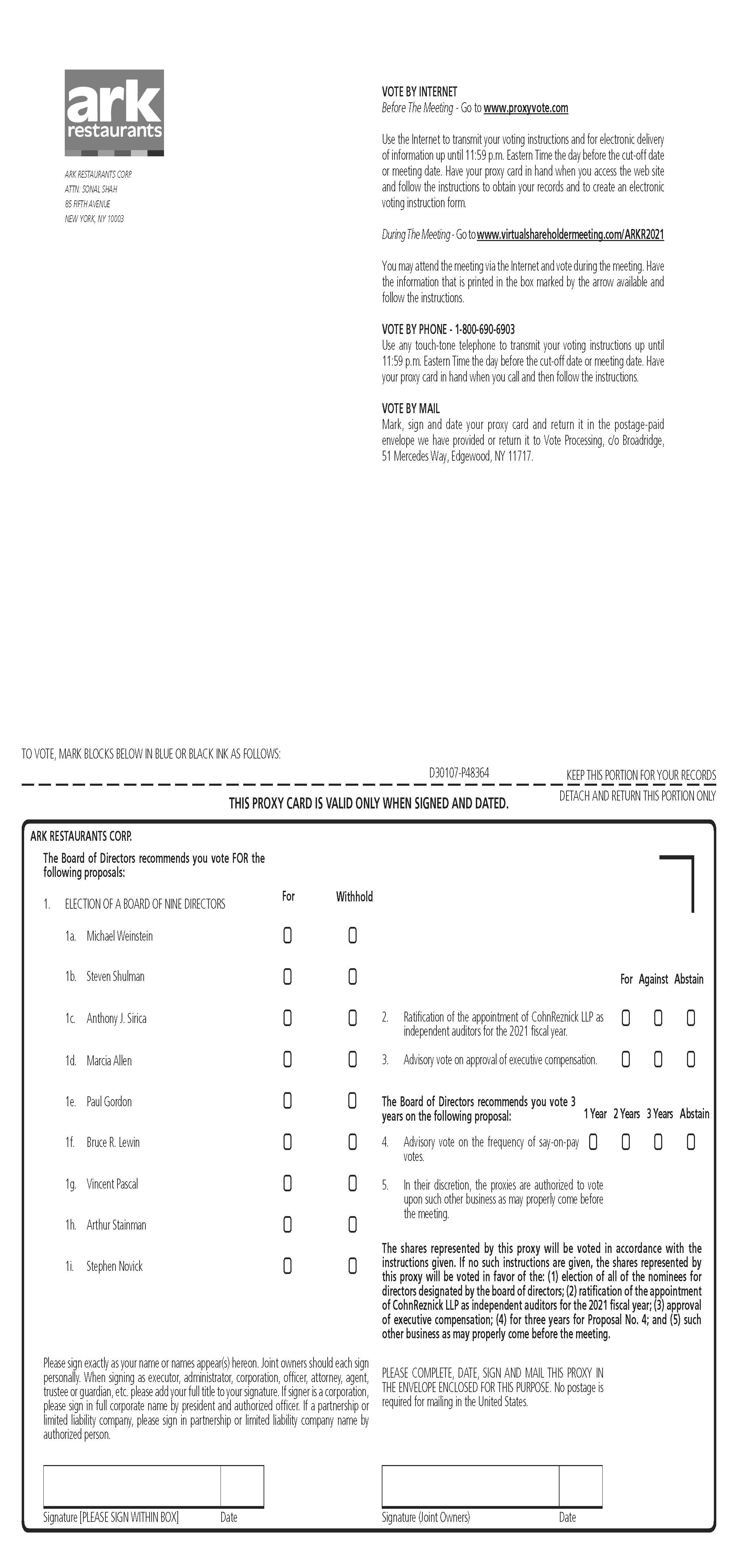

Your vote is important. Whether or not you are able to attend the Annual Meeting, it is important that your shares be represented. To ensure your vote is recorded promptly, please vote as soon as possible, even if you plan to attend the Annual Meeting, by submitting your proxy via the telephone at 1 (800) 690-6903 or via the Internet at virtualshareholdermeeting.com/ARKR2021 or by completing, signing and dating the proxy card and returning it in the postage-prepaid envelope, if you have requested that a paper copy be mailed to you.

YOU ARE REQUESTED, WHETHER OR NOT YOU PLAN TO BE PRESENT AT THE MEETING, TO DATE, SIGN AND RETURN PROMPTLY THE ACCOMPANYING PROXY IN THE ENCLOSED ENVELOPE TO WHICH NO POSTAGE NEED BE AFFIXED IF MAILED IN THE UNITED STATES. IF YOU ATTEND THE MEETING IN PERSON, OR VIRTUALLY, YOU MAY WITHDRAW A PREVIOUSLY SUBMITTED PROXY AND VOTE YOUR OWN SHARES AT THE MEETING.

| | | | | |

| By Order of the Board of Directors, |

| |

| Anthony J. Sirica |

| President and Chief Financial Officer |

| |

| New York, New York | |

February 4, 20212, 2024 | |

ARK RESTAURANTS CORP.

PROXY STATEMENT

ANNUAL MEETING INFORMATION

This proxy statement contains information related to the annual meetingAnnual Meeting of shareholdersShareholders of Ark Restaurants Corp., a New York corporation (“Ark” or the “Company”) to be held via a live webcast by accessing virtualshareholdermeeting.com/ARKR2021at Bryant Park Grill, located at 25 West 40th Street, New York, New York, at 10:00 A.M., New York City time, on March 16, 202112, 2024 and at any adjournment or adjournmentspostponement thereof (the “Meeting”). This proxy statement was prepared under the direction of our Board of Directors (the “Board of Directors” or the “Board”) to solicit your proxy for use at the annual meeting.Meeting. This proxy statement and the accompanying proxy are being first mailed to shareholders on or about February 4, 2021.6, 2024. Certain of our officers and employees may solicit proxies by correspondence, telephone or in person, without extra compensation. We may also pay to banks, brokers, nominees and certain other fiduciaries their reasonable expenses incurred in forwarding proxy materials to the beneficial owners of securities held by them.

Throughout this Proxy Statement, the terms “we,” “us,” “our” and the “Company” refer to Ark Restaurants Corp. and, unless the context indicates otherwise, our subsidiaries on a consolidated basis; and “you” and “your” refers to the shareholders of ourthe Company.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on March 16, 2021.12, 2024.

This Proxy Statement, the form of proxy and the Company’s Annual Report are available at www.proxyvote.com.

QUESTIONS AND ANSWERS ABOUT THE MEETING

Who may vote?

You may vote if you owned our common stock as of the close of business on the Record Date.January 16, 2024 (the "Record Date"). Each share of your common stock is entitled to one vote on each of the proposals scheduled for vote at the Meeting. As of the Record Date, there were 3,521,9073,604,157 shares of common stock outstanding and entitled to vote at the Meeting. Shares of common stock that are present virtually during the Annual Meeting constitute shares of common stock represented "in person."

Who may attend the annual meeting?Meeting?

All shareholders of record at the close of business on January 25, 2021 (the “Record Date”),the Record Date, or their duly appointed proxies, and our invited guests may attend the Meeting.

Who may vote at the Meeting?

If your shares are held in an account at a brokerage firm, bank, broker-dealer or other similar organization, then you are the beneficial owner of shares held in “street name,” and the Notice of Internet Availability was forwarded to you by that organization. The organization holding your account is considered the stockholdershareholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct that organization on how to vote the shares held in your account.

Shares of common stock held in a stockholder’sshareholder's name as the stockholdershareholder of record may be voted in person at the Annual Meeting. Shares of common stock held beneficially in street name may be voted in person only if you obtain a legal proxy from the broker, trustee or nominee that holds your shares giving you the right to vote the shares.

Whether you hold shares directly as the stockholdershareholder of record or beneficially in street name, you may direct how your shares are voted without attending the Annual Meeting. If you are a stockholdershareholder of record, you may vote by submitting a proxy electronically via the Internet, by telephone or if you have requested a paper copy of these proxy materials, by returning the proxy or voting instruction card. If you hold shares beneficially in street name, you may vote by submitting voting instructions to your broker, trustee or nominee.

What will I be voting on?

You will be voting on the following:following proposals at the Meeting:

| | | | | | | | |

| • | The election of nine (9) directors for a term to expire at the next annual meeting of shareholders; |

| • | The ratification of the selection of CohnReznick LLP (“Cohn”) as our independent registered public accounting firm for fiscal 2021; |

| • | To hold an advisory vote on executive compensation; and |

| • | To hold an advisory vote on the frequency of the advisory vote on executive compensation. |

•To elect a board of eight directors identified as standing for election in this proxy statement, each to serve until the 2025 Annual Meeting of Shareholders and until their successors are duly elected (Proposal No. 1);

•To ratify the appointment of CohnReznick LLP (“Cohn”) as our independent registered public accounting firm for the 2024 fiscal year (Proposal No. 2); and

•To vote on a non-binding advisory resolution to approve the compensation of our named executive officers (Proposal No. 3).

What are the voting recommendations of the Board of Directors?

The Board of Directors recommends that you vote your shares “FOR” each of the nominees named in this proxy statement for election to the Board; “FOR” the ratification of the selection of Cohn as our independent registered public accounting firm for fiscal 2021, "FOR" adoption2024; and “FOR” the approval of the non-binding advisory vote onresolution approving the Company's executive compensation, "FOR" such advisory vote to be held every three years, and in accordance with the proxy holders best judgment as to any other matters raised at the annual meeting.compensation.

How do I vote?

By Mail: You may vote by completing, signing and returning the enclosed proxy card in the postage-paid envelope provided with this proxy statement. The proxy holders will vote your shares according to your directions. If you sign and return your proxy card without specifying choices, your shares will be voted by the persons named in the proxy in accordance with the recommendations of the Board of Directors as set forth in this proxy statement.

Virtually DuringAt the Meeting. You may cast your vote online duringin person at the virtual meeting through virtualshareholdermeeting.com/ARKR2021. ToMeeting. Written ballots will be admittedpassed out to anyone who wants to vote in person at the Annual Meeting and vote your shares, you must go to virtualshareholdermeeting.com/ARKR2021 on the day of the Annual Meeting and provide the control number located on the Notice of Internet Availability or proxy card.Meeting.

Via the Internet: You may vote by proxy via the Internet at www.proxyvote.com by following the instructions provided on the Notice of Internet Availability or proxy card. You must have the control number that is on the Notice of Internet Availability or proxy card when voting.

By Telephone: If you live in the United States or Canada, you may vote by proxy via the telephone by calling 1 (800) 690-6903. You must have the control number that is on the Notice of Internet Availability or proxy card when voting.

Even if you plan to attend the meeting virtually,Meeting, you are encouraged to vote your shares by proxy. You may still vote your shares in person at the Meeting even if you have previously voted by proxy. If you are present at the Meeting and desire to vote in person, your vote by proxy will not be used.

What if I hold my shares in “street name”?

You should follow the voting directions provided by your broker or nominee. You may complete and mail a voting instruction card to your broker or nominee or, in most cases, submit voting instructions by telephone or the Internet to your broker or nominee. If you provide specific voting instructions by mail, telephone or the Internet, your broker or nominee will vote your shares as you have directed.

Can I change my mindvote after I vote?have voted?

Yes. If you are a shareholder of record, you may change your vote or revoke your proxy at any time before it is voted at the Meeting by: | | | | | | | | |

| • | signing another proxy card with a later date and returning it to us prior to the Meeting; |

| • | giving written notice of revocation to Ark Restaurants., Attention: Treasurer, 85 Fifth Avenue, New York, NY 10003; or |

| • | attending the Meeting and voting in person. |

•signing another proxy card with a later date and returning it to us prior to the Meeting;

•giving written notice of revocation to Ark Restaurants Corp., Attention: Secretary, 85 Fifth Avenue, New York, NY 10003; or

•attending the Meeting and voting in person.

If you hold your shares in street name, you may submit new voting instructions by contacting your broker, bank or other nominee. You may also vote in person at the Meeting if you obtain a legal proxy from your broker, bank or other nominee.

Who will count the votes?

A representative of our Transfer Agent will count the votes and will serve as the independent inspector of elections.

Will myHow are abstentions and broker non-votes treated?

Abstentions (i.e., shares be voted if I do not provide my proxy?

If youpresent at the Meeting and marked “abstain”) are the shareholder of record and you do not vote or provide a proxy, your shares will not be voted.

Under the rules of various national and regional securities exchanges, brokers may generally vote on certain, limited “routine” matters, but cannot vote on non-routine matters, such as the non-contested election of directors or an amendment to the Articles of Incorporation or the adoption or amendment of a stock option plan, unless they have received voting instructions from the person for whom they are holding shares. If your broker does not receive instructions from you on how to vote particular shares on matters on which your broker does not have discretionary authority to vote, your broker will return the proxy form to us, indicating that he or she does not have the authority to vote on these matters. This is generally referred to as a “broker non-vote” and will affect the outcome of the voting as described below, under “What vote is required to approve each proposal?” Therefore, we encourage you to provide directions to your broker as to how you want your shares voted on all mattersdeemed to be brought before the meeting. You should do thisshares presented or represented by carefully following the instructions your broker gives you concerning its procedures. This ensures that your shares will be voted at the meeting.

How many votes must be present to hold the meeting?

A majority of the outstanding sharesProxy and entitled to vote, at the Meeting, represented in person or by proxy, will constitute a quorum. Shares of common stock represented in person or by proxy, including shares which abstain or do not vote with respect to one or more of the matters presented for shareholder approval, will beand are counted for purposes of determining whether a quorum is present.

WhatA broker non-vote occurs when the beneficial owner of shares fails to provide the bank, broker or other nominee that holds the shares with specific instructions on how to vote is requiredon any “non-routine” matters brought to approve each proposal?

In accordance with our bylaws, the nominees for director receiving the highest number of votes cast in person or by proxya vote at the Meeting (also referred to as a plurality ofshareholders meeting. In this situation, the votes cast)bank, broker or other nominee will be elected.not vote on the “non-routine” matters. Broker non-votes will not beare counted as entitled to vote, but will count for purposes of determining whether or not a quorum is presentpresent.

For Proposal No. 1, votes that are withheld from a director's election and broker non-votes are not treated as votes cast “for” or “against” the proposal and, therefore, will have no effect on the matter. The affirmative vote of a majorityoutcome of the vote.

For Proposal No. 2, abstentions and broker non-votes will not have any effect on the proposal.

For Proposal No. 3, abstentions and broker non-votes will not have any effect on the proposal.

Note that if you are a beneficial holder, banks, brokers and other nominees will be entitled to vote your shares representedon “routine” matters without instructions from you. The only proposal that would be considered “routine” in person or by proxy at the annual meetingsuch event is required for approval of the proposal to ratifyfor the ratification of the appointment of Cohn as our independent registered public accounting firm for the fiscal 2021. If you mark your proxy to withhold your vote for a particularyear 2024 (Proposal No. 2). A bank, broker or other nominee on your proxy card, your vote will not count either “for” or “against” the nominee. Therefore, a broker non-vote has no effect on the proposals provided herein to be voted on at the Meeting. Shares that abstain from voting as to a particular matter will not be counted as votes in favorentitled to vote your shares on any “non-routine” matters, absent instructions from you. This year, the “non-routine” matters relate to the election of such matter,directors (Proposal No. 1) and also will not be counted as votes cast or shares voting on such matter. Accordingly, abstentions will not be included in vote totals and will not affect the outcome of the voting for any of the proposals.

Because the votes on the non-binding resolution to approveadvisory vote regarding the compensation of our named executive officers (Proposal No. 3). Accordingly, we encourage you to provide voting instructions to your bank, broker or other nominee whether or not you plan to attend the Meeting.

How many votes must be present to hold the Meeting?

The holders of a majority in voting power of all stock issued, outstanding and entitled to vote at the frequencyMeeting must be present in person or by proxy to hold the Meeting and conduct business. This is called a quorum. Abstentions and broker “non-votes” are counted as present or represented for purposes of determining the presence or absence of a quorum. A “non-vote” occurs when a broker holding shares for a beneficial owner votes on one proposal, but does not vote on another proposal because, in respect of such compensation are advisory, they willother proposal, the broker does not be binding on the Board of Directors of the Company. However, the Board will review the voting results and take them into consideration when making future decisions regarding executive compensation.

Our directors, director-nominees and executive officers own, directly or indirectly, approximately 40.4% of thehave discretionary voting power entitled toand has not received instructions from the beneficial owner. Shares voted in the manner described above will be castcounted as present at the Meeting. We anticipate that these directors and executive officers will cast all of their votes in favor of each ofIf a quorum is not present, the proposals being considered at the Meeting. Shareholders are not entitled to dissenter’s rights of appraisal with respect to any of the proposals.

What do you need to do to attend the Annual Meeting?

The 2021 Annual Meeting will be adjourned until a completely virtual meeting. There will be no physical meeting location. The meeting will only be conducted via live webcast. We have adopted a virtual format this year for our Annual Meeting in light of the public health impact of the coronavirus pandemic (COVID-19), the increasingly strict protocols that federal, state and local governments have imposed, and to support the health and well-being of our stockholders, employees and their families. This virtual-meeting format uses technology designed to increase stockholder access and provide stockholders rights and opportunities to participate in the meeting similar to what they would have at an in-person meeting.quorum is obtained.

Who will pay for this proxy solicitation?

We will bear the cost of preparing, assembling and mailing the proxy materialmaterials and of reimbursing brokers, nominees, fiduciaries and other custodians for out-of-pocket and clerical expenses of transmitting copies of the proxy materialmaterials to the beneficial owners of our shares. A few of our officers and employees may participate in the solicitation of proxies without additional compensation.

Will any other matters be voted on at the Meeting?

As of the date of this proxy statement, our management knows of no other matter that will be presented for consideration at the Meeting other than those matters discussed in this proxy statement. If any other matters properly come before the Meeting and call for a vote of shareholders, validly executed proxies in the enclosed form returned to us will be voted in accordance with the recommendation of the Board of Directors, or, in the absence of such a recommendation, in accordance with the judgment of the proxy holders.

What are the deadlines for stockholdershareholder proposals for next year’s Meeting?

StockholdersShareholders may submit proposals on matters appropriate for stockholdershareholder action at future annual meetings by following the rules of the United States Securities and Exchange Commission.Commission (the "SEC"). Please see “Shareholder Proposals intendedand Nominations for inclusion in next year’s proxy statement and proxy card must be received by not later than October 15, 2021. AllDirectors” for further information on how to submit proposals and notifications should be addressed to Ark Restaurants Corp., Attention: Treasurer, 85 Fifth Avenue, New York, NY 10003. Any such shareholder proposal must comply withrecommendations for Board nominees for the requirements2025 Annual Meeting of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).Shareholders.

Where can I find the voting results?

The preliminary voting results will be announced at the Meeting. The final results will be published in a current reportCurrent Report on Form 8-K filed with the SEC within four (4) business days after the Meeting.

What is the Company’s website address?

Our website address is www.arkrestaurants.com. We make this proxy statement, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) available on our website in the About Ark – Investors – SEC Filings section, as soon as reasonably practicable after electronically filing such material with the United States Securities and Exchange Commission (“SEC”).SEC.

This information is also available free of charge at the SEC’s website located at www.sec.gov. Shareholders may also read and copy any reports, statements and other information filed by us with the SEC at the SEC public reference room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 or visit the SEC’s website for further information on its public reference room.

The references to our website address and the SEC’s website address do not constitute incorporation by reference of the information contained in these websites and should not be considered part of this document.

CORPORATE GOVERNANCE; DIRECTOR AND COMMITTEE INFORMATION

Corporate Governance

We seek to follow best practices in corporate governance in a manner that is in the best interests of our business and stockholders.shareholders. Our current corporate governance principles, including the Code of Ethics (which includes our insider trading policy) and the charters of each of the Audit Committee, Compensation Committee and Nominating and Governance Committee are all available under About Ark – Investors – Corporate Governance on our website at www.arkrestaurants.com. We are in compliance with the corporate governance requirements imposed by the Sarbanes-Oxley Act, the Securities and Exchange CommissionSEC and the NASDAQ Marketplace Rules. We will continue to modify our policies and practices to meet ongoing developments in this area. Aspects of our corporate governance principles are discussed throughout this Proxy Statement.

Director Independence

The Board has determined that each of the following directors is an “independent director” as such term is defined in NASDAQ Marketplace Rule 4200(a)(15): Bruce R. Lewin, Marcia Allen, Steven Shulman, Arthur StainmanJessica Kates and Stephen Novick. The Company does not utilize any other definition or criteria for determining the independence of a director or nominee, and no other transactions, relationships, or other arrangements exist to the Board’s knowledge or were considered by the Board, other than as may be discussed herein, in determining any such director’s or nominee’s independence.

Director Diversity

We strive to have the members of our Board of Directors possess a diverse set of skills and background so as to best provide guidance to the management team and oversight to the Company. While the Nominating and Corporate Governance Committee does not have a formal policy in this regard, the Nominating and Corporate Governance Committee views diversity broadly to include a diversity of experience, skills and viewpoint, as well as diversity of gender and race. The Nominating and Corporate Governance Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. Skills sought include financial, capital markets, manufacturing, engineering, executive leadership, sales and marketing, organizational growth, human resources and strategic planning. We believe our Board of Directors has a minimum of one director for each of these skills.

Under NASDAQ’s Board diversity rule, approved by the SEC in August 2021, companies listed on NASDAQ’s U.S. exchange are required, subject to a phase-in period and certain exceptions, to (a) publicly disclose board-level diversity statistics using a standardized matrix and (b) have, or explain why they do not have, at least two directors who are diverse, including at least one diverse director who self-identifies as female and at least one diverse director who self-identifies as an underrepresented minority or LGBTQ+. The new rule is aimed at encouraging a minimum board diversity objective for companies and provide shareholders with consistent, comparable disclosures concerning a company’s current board composition.

Current and Proposed Board Diversity Matrix

| | | | | | | | | | | | | | |

| Total Number of Directors | 8 |

| Female | Male | Non-Binary | Did Not

Disclose

Gender |

| Part I: Gender Identity | | | | |

| Directors | 2 | 6 | — | — |

| Part II: Demographic Background | | | | |

| African American or Black | — | — | — | — |

| Alaskan Native or Native American | — | — | — | — |

| Asian | — | — | — | — |

| Hispanic or Latinx | — | — | — | — |

| Native Hawaiian or Pacific Islander | — | — | — | — |

| White | 2 | 5 | — | — |

| Two or more Races or Ethnicities | — | — | — | — |

| LGBTQ+ | 1 |

| Did not disclose demographic background | 1 |

Board Leadership Structure

Our Board does not have a policy as to whether the roles of Chairman of the Board and Chief Executive Officer should be separate or combined. Currently, the office of Chairman of the Board and Chief Executive Officer are held by Michael Weinstein. The Company does not have a lead independent director. Our Board has determined that its current structure, with combined Chairman and CEO roles, is in the best interests of the Company and its shareholders at this time. A number of factors support the leadership structure chosen by the Board, including, among others:

•Mr. Weinstein has extensive knowledge of all aspects of the Company and its business and risks, its industry and its customers;

•Mr. Weinstein is intimately involved in the day-to-day operations of the Company and is best positioned to elevate the most critical business issues for consideration by the Board of Directors;

•The Board believes having Mr. Weinstein serve in both capacities allows him to more effectively execute the Company’s strategic initiatives and business plans and confront its challenges;

•A combined Chairman and CEO structure provides the Company with decisive and effective leadership with clearer accountability to our shareholders and customers; and

•In our view, splitting the roles would potentially make our management and governance processes less effective through undesirable duplication of work and possibly lead to a blurring of clear lines of accountability and responsibility.

Board’s Role in Risk Oversight

Our Board believes that open communication between management and the Board is essential for effective risk management and oversight. The Board meets with our Chief Executive Officer and other members of senior management at Board meetings, where, among other topics, they discuss strategy and risks in the context of reports from the management team and evaluate the risks inherent in significant transactions.

One of the key functions of our Board of Directors is informed oversight of our risk management process. It administers this oversight function directly through the Board of Directors as a whole, as well as through its standing committees that address risks inherent in their respective areas of oversight. Areas of focus include economic, operational, financial (accounting, credit, investment, liquidity and tax), competitive, legal, technical, regulatory, compliance and reputational risks, and more recently, risk exposures related to COVID-19. The risk oversight responsibility of our Board of Directors and its committees is supported by our management reporting processes, which are designed to provide visibility to our Board of Directors and to our personnel who are responsible for risk

assessment and information about the identification, assessment and management of critical risks, and our management’s risk mitigation strategies.

While our Board is ultimately responsible for risk oversight, our Board committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk. For more information about our Board committees, please see the sections titled “Compensation Committee,” “Audit Committee” and “Nominating and Corporate Governance Committee” below. We believe this division of responsibilities is an effective approach for addressing the risks we face and that our Board leadership structure supports this approach.

Board and Committee Meeting Attendance

During the past fiscal year, the Board held fourfive meetings. Each member of the Board attended at least 75% of the meetings of the Board and committees on which he or she served. Independent directors met twice last year in executive session without management present.

Board Committees

The Board has delegated various responsibilities and authority to different Board committees. The Board has three standing committees: the Compensation Committee, the Audit Committee and the Nominating and Corporate Governance Committee. The Board has appointed only independent directors to such committees. The members of each committee are appointed by the Board and serve one-year terms. Committees regularly report on their activities and actions to the full Board of Directors. Each committee has a written charter adopted by the Board of Directors under which it operates.

Compensation Committee

Mr. StainmanNovick (Chairperson), Mr. Shulman and Ms. Allen currently serve as members of the Compensation Committee of the Board. The Compensation Committee (i) oversees and sets the compensation and benefits arrangements of our Chief Executive Officer and certain other executives; (ii) provides a general review of, and makes recommendations to, the Board of Directors or to our shareholders with respect to our cash-based and equity-based compensation plans; and (iii) implements, administers, operates and interprets our equity-based and similar compensation plans to the extent provided under the terms of such plans. The Compensation Committee has the authority to make decisions respectingwith respect to CEO and executive officer compensation matters, including employment and severance contracts, salary, compensation awards and bonuses, among other things, and has the right to retain and terminate compensation consultants, legal counsel and other advisors to assist the committeeCommittee with its functions. The Committee may delegate authority to subcommittees of the Compensation Committee or to executive officers (with respect to compensation determinations for non-executive officers), as well as delegate authority to the Company’s CEO to approve options to employees (who are not directors or executive officers) of the Company or of any subsidiary of the Company, subject to certain quantity, time and price limitations.

The Board of Directors adopted a written charter under which the Compensation Committee operates. The Board of Directors reviews and assesses the adequacy of the charter of the Compensation Committee on an annual basis. The Board of Directors has determined that all of the members of the Compensation Committee meet the independence criteria for compensation committees and have the qualifications set forth in the listing standards of NASDAQ.

The Compensation Committee held one meeting induring fiscal 2020.

Audit Committee

Messrs.Mr. Lewin (Chairperson) and Stainman, Ms. Kates and Ms. Allen currently serve as members of the Audit Committee of the Board of Directors. The Audit Committee is responsible for, among other things, engaging the independent auditors, receiving and reviewing the recommendations of the independent auditors, reviewing consolidated financial statements of the Company, meeting periodically with the independent auditors and Company personnel with respect to the adequacy of internal accounting controls, resolving potential conflicts of interest and reviewing the Company’s accounting policies.

The Board of Directors has determined that all of the members of the Audit Committee meet the independence criteria for audit committees and have the qualifications set forth in the listing standards of NASDAQ and Rule 10A-3 under the Exchange Act.

The Board of Directors has also designated Ms. Allen as an audit committeeAudit Committee financial expert within the meaning of Item 401(h) of Regulation S-K under the Exchange Act, and the Board of Directors has determined that she has the financial sophistication required under the listing standards of NASDAQ.

The Board of Directors adopted a written charter under which the Audit Committee operates. The Board of Directors reviews and assesses the adequacy of the charter of the Audit Committee on an annual basis.

The Audit Committee held four meetings during fiscal 2020.2023.

Nominating and Corporate Governance Committee

Messrs. Novick (Chairperson), Stainman and Lewin and Ms. Allen currently serve as members of the Nominating and Corporate Governance Committee of the Board. The Board of Directors adopted a written charter under which the Nominating and Corporate Governance Committee operates. The Nominating and Corporate Governance Committee approved the nomination of the candidates reflected in Proposal One,No. 1, which candidates were approved by the Board of Directors.

The duties of the Nominating and Corporate Governance Committee are to recommend to the Board nominees to the Board of Directors and its standing committees. Although the Nominating and Corporate Governance Committee has not established minimum qualifications for director candidates, it will consider, among other factors:

•Diversity

•Experience with businesses and other organizations of comparable size

•The interplay of the candidate’scandidate's experience with the experience of other Board members

•The extent to which the candidate would be a desirable addition to the Board and any committeescommittee of the Board

The Nominating and Corporate Governance Committee will consider all director candidates recommended by stockholders. Any stockholder who desiresshareholders. If a shareholder wishes to recommend a candidate for election as a director candidate may do soat the 2025 Annual Meeting of Shareholders, it must follow the procedures described in writing, giving each recommended candidate’s name, biographical data“Shareholder Proposals and qualifications, by mail addressedNominations for Directors” below.

The Company does not have a formal policy with regard to the Chairmanconsideration of diversity in identifying director nominees, but the Nominating and Corporate Governance Committee strives to nominate directors with a variety of complementary skills so that, as a group, the Board will possess the appropriate talent, skills, and expertise to oversee the Company’s business. In addition to considering a candidate’s background and accomplishments, candidates are reviewed in care of Ark Restaurants Corp., 85 Fifth Avenue, New York, New York 10003. Membersthe context of the Nominatingcurrent composition of the Board and Corporate Governance Committee will assess potential candidates onthe evolving needs of our business. The Company’s policy is to have at least a regular basis.majority of directors qualify as “independent” under the listing requirements of NASDAQ.

The Nominating and Corporate Governance Committee held one meeting during fiscal 2020.

There are no family relationships among any of the directors or executive officers (or any nominee therefor)therefore) of the Company, and no arrangements or understandings exist between any director or nominee and any other person pursuant to which such director or nominee was or is to be selected with respect to the election of directors. No director or executive officer (or any nominee therefortherefore or any associate thereof) has any substantial interest, direct or indirect, by security holdings or otherwise, in any proposal or matter to be acted upon at the Meeting (other than the election of directors). There are no events or legal proceedings material to an evaluation of the ability or integrity of any director or executive officer, or any nominee therefor,therefore, of the Company. Moreover, no director or executive officer of the Company, nor any nominee, is a party adverse to the Company or has a material interest adverse to the Company in any legal proceeding.

Stockholder

Shareholder Proposals and Nominations for Directors

We must receive shareholder proposals for inclusion in our proxy materials for the 2025 Annual Meeting of Shareholders pursuant to Rule 14a-8 of the Securities Exchange Act of 1934 no later than October 9, 2024. These proposals must also meet the other requirements of the rules of the SEC and our Amended and Restated Bylaws (the “Bylaws”).

Our Bylaws establish an advance notice procedure with regard to proposals that shareholders otherwise desire to introduce at our 2025 Annual Meeting of Shareholders without inclusion in our proxy statement for that meeting. Written notice of such shareholder proposals and director nominations for our 2025 Annual Meeting of Shareholders must be received by our Board of Directors, c/o Secretary, Ark Restaurants Corp., 85 Fifth Avenue, New York, New York 10003, not later than December 12, 2024 and must not have been received earlier than November 12, 2024 in order to be considered timely, and must contain specified information concerning the matters proposed to be brought before such meeting and concerning the shareholder proposing such matters. The matters proposed to be brought before the meeting also must be proper matters for shareholder action. If a shareholder who wishes to nominate a director or make a proposal fails to notify us within this time frame, the proposal will not be addressed at our 2025 Annual Meeting of Shareholders. If a shareholder makes a timely notification, the proxies that management solicits for the meeting will have discretionary authority to vote on the shareholder’s proposal under circumstances consistent with the proxy rules of the SEC. In addition to satisfying the advance notice procedure in our Bylaws with respect to director nominations, shareholders who intend to solicit proxies in support of director nominees other than the Company’s nominees for the 2025 Annual Meeting of Shareholders must provide notice that sets forth the information set forth in Rule 14a-19 under the Exchange Act and the Bylaws, either postmarked or transmitted electronically to the Company no later than January 13, 2025.

Pursuant to our Bylaws, the notice must set forth: (a) for each nominee (i) information as would be required to be included in a proxy statement filed pursuant to the proxy rules of the SEC, and (ii) written consent to be named in any proxy statement and any associated proxy card and serve as director if so elected; (b) as to any other business that the shareholder proposes to bring before the meeting, a brief description of any proposed business including (i) the text of such proposal and any accompanying resolutions, (ii) the reasons for conducting such business at the meeting, and (iii) any material interest held by the proposing shareholder or any beneficial owner on whose behalf the proposal is made; and (c) proposing shareholder and/or beneficial owner information including, (i) name and address, (ii) the class and number of shares of capital stock held, (iii) a description of any agreement, arrangement or understanding with respect to the nomination or proposal with any of their affiliates or associates, and any others acting in concert with the foregoing, (iv) a description of any agreement, arrangement or understanding with respect to shares of our stock entered into by the date of such notice for the purposes of loss mitigation, risk management or derivation of benefit from share price changes and/or redistribution of voting power, (v) a representation that such shareholder is the holder of record, is entitled to vote, and intends to appear in person or by proxy and propose such business or nomination, (vi) a representation of intention to either deliver proxy statements to holders of the necessary percentage of shares or to solicit proxies in support of the proposal, and (vii) any other information relating to such shareholder and/or beneficial owner required to be disclosed in filings made in connection with solicitation of proxies pursuant to the Exchange Act. The shareholder can alternatively satisfy the notice requirement by submitting proposals in compliance with SEC requirements and inclusion of such proposal within a proxy statement we prepare. Compliance with our Bylaws shall be the exclusive means for a shareholder to make nominations or submit other business to the annual meeting (other than matters properly brought in compliance with the rules of the Exchange Act).

Shareholder Communications

The Board welcomes communications from stockholders,shareholders, which may be sent to the entire Board at the principal business address of the Company, Ark Restaurants Corp., 85 Fifth Avenue, New York, New York 10003, Attn: Treasurer.Secretary. Security holder communications are initially screened to determine whether they will be relayed to Board members. Once the decision has been made to relay such communications to Board members, the Secretary will release the communication to the Board on the next business day. Communications that are clearly of a marketing nature, or which are unduly hostile, threatening, illegal or similarly inappropriate will be discarded and, if warranted, subject to appropriate legal action.

Recognizing that director attendance at the Company’s annual meetingsAnnual Meetings of stockholdersShareholders can provide stockholdersshareholders with an opportunity to communicate with members of the Board of Directors, it is the policy of the Board of Directors to encourage, but not require, the members of the Board to attend such meetings. Seven board members attended our 2023 Annual Meeting.

PROPOSAL No. 1: ELECTION OF DIRECTORS

Our Amended and Restated Certificate of Incorporation provides that the number of directors constituting the Board of Directors shall not be fewer than three nor more than 15, with the exact number to be fixed by a resolution adopted by the affirmative vote of a majority of the Board. The Board of Directors has fixed the number of directors at nine.eight. The term of office of each director is one year, commencing at this annual meeting and ending at the annual meetingAnnual Meeting of shareholdersShareholders to be held in 2022.2025. Each director elected will continue in office until he or she resigns or until a successor has been elected and qualified. StockholdersShareholders cannot vote or submit proxies for a greater number of persons than the nineeight nominees named in this Proposal One.

Each of the nominees named below is at present a director of the Company and has consented to serve if elected. If any nominee should be unable to serve or will not serve for any reason, the persons designated on the accompanying form of proxy will vote in accordance with their judgment. We know of no reason why the nominees would not be able to serve if elected.

The following is a brief account of the business experience during the past five years of each of the Company’s directors and executive officers, including principal occupations and employment during that period and the name and principal business of any corporation or other organization in which such occupation and employment was carried on.

| | Name | Name | | Age | | Position | | Director

Since | Name | | Age | | Position | | Director

Since |

| | Michael Weinstein | Michael Weinstein | | 77 | | Chairman of the Board and Chief Executive Officer | | 1983 | Michael Weinstein | | 80 | | Chairman of the Board and Chief Executive Officer | | 1983 |

| Anthony J. Sirica | Anthony J. Sirica | | 57 | | Director and Chief Financial Officer | | 2018 | Anthony J. Sirica | | 60 | | Director, President and Chief Financial Officer | | 2018 |

| Vincent Pascal | Vincent Pascal | | 77 | | Director and Chief Operating Officer and Senior Vice President | | 1985 | Vincent Pascal | | 80 | | Director and Chief Operating Officer and Senior Vice President | | 1985 |

| Paul Gordon | | 69 | | Director and Senior Vice President | | 1996 | |

| Marcia Allen | Marcia Allen | | 70 | | Director | | 2003 | Marcia Allen | | 73 | | Director | | 2003 |

| Jessica Kates | | Jessica Kates | | 45 | | Director | | 2022 |

| Bruce R. Lewin | Bruce R. Lewin | | 73 | | Director | | 2000 | Bruce R. Lewin | | 76 | | Director | | 2000 |

| Stephen Novick | | Stephen Novick | | 83 | | Director | | 2005 |

| Steven Shulman | Steven Shulman | | 79 | | Director | | 2003 | Steven Shulman | | 82 | | Director | | 2003 |

| Arthur Stainman | | 78 | | Director | | 2004 | |

| Stephen Novick | | 80 | | Director | | 2005 | |

Biographical Information

Michael Weinstein has been our Chief Executive Officer and a director since our inception in January 1983, was elected Chairman in 2004 and was President of the Company from January 1983 to September 2007. Mr. Weinstein is also an executive officer of each of our subsidiaries. Mr. Weinstein is an officer, director and 29.67% shareholder of RSWB Corp. and a director and 28% owner of BSWR Corp. (since 1998). Collectively, these companies operate two restaurants in New York City, and none of these companies is a parent, subsidiary or other affiliate of us. Mr. Weinstein spends substantially all of his business time on Company-related matters.

Anthony J. Siricahas been employed by us since September 2018 as Chief Financial Officer and was appointed to fill a vacancy on the Board of Directors as of such date. Prior to his appointment, Mr. Sirica served as the Managing Member of Forum Consulting, LLC (“Forum”), since February 2006. Forum was a New York-based management advisory services firm that provided accounting and financial consulting services and corporate governance support primarily to issuers registered with the Securities and Exchange Commission (“SEC”) in the Tri-State area, including Ark Restaurants Corp. Prior to his tenure at Forum, Mr. Sirica served in various capacities with the international accounting firm of BDO Seidman, LLP, including the National Business Line Leader of their risk consulting division and Audit Partner. Mr. Sirica is a certified public accountant.

Vincent Pascal has been employed by us since 1983 and was elected Vice President, Assistant Secretary and a director in 1985. Mr. Pascal became a Senior Vice President in 2001 and Chief Operating Officer in 2011.

Paul Gordon has been employed by us since 1983 and was elected as a director in November 1996 and a Senior Vice President in April 2001. Mr. Gordon is the manager of our Las Vegas operations, and is a Senior Vice President of each of the Company’s Las Vegas, Nevada subsidiaries. Prior to assuming that role in 1996, Mr. Gordon was the manager of the Company’s operations in Washington, D.C. commencing in 1989.

Marcia Allen was elected a director of the Company in 2003. Since 2008, Ms. Allen has been the Chief Executive Officer of Allen & Associates Inc., a business and acquisition consulting firm.Currently, Ms. Allen also serves on the Board of Directors of INmune Bio, Inc. (NASDAQ - INMB) and is a Directordirector of several private companies.

Jessica Kates was elected a director of the Company in 2022. Since 2019, Ms. Kates has been the Co-Founder and Managing Partner of Rellevant Partners LLC, a female-founded growth equity firm focused on the restaurant, restaurant technology, and food and beverage industries. Currently, Ms. Kates also serves as the Interim Chief Financial Officer of Allonnia, LLC, and Liberation Labs

Holdings Inc. Ms. Kates also serves on the Board of Directors of The Good Dog Foundation and RASA. Prior to 2019, Ms. Kates was a Partner in Trispan's restaurant-focused private equity fund, where she served on the Board of Yardbird, Rosa Mexicano and Stacked.

Bruce R. Lewin was elected a director of the Company in February 2000. Mr. Lewin was the President and a director of Continental Hosts, Ltd from August 2001 until its sale in 2018. He was also a founder and board member of Fuze Beverage, LLC. Mr. Lewin was formerly a director of the Bank of Great Neck (in New York), and a former director of the New York City Chapter of the New York State Restaurant Association. He has been owner and President of Bruce R. Lewin Fine Art since 1985.

Steven Shulman was elected a director of the Company in December 2003. During the past five years, Mr. Shulman has been the managing director of Hampton Group, a company engaged in the business of making private investments. Mr. Shulman also serves as a director of various private companies and as a strategic advisor to Ancoris Capital Partners.

Arthur Stainman was elected a director of the Company in 2004. As of January 1, 2021, Mr. Stainman is a limited partner of First Manhattan Co. of New York City, a money management firm. Prior to that he was a senior managing director at First Manhattan Co. of New York City and has over twenty years’ experience managing money for high net worth individuals. Mr. Stainman is a Trustee of Rider University and sits on the board of several New York based non-profits.

Stephen Novick was elected a director of the Company in 2005. Mr. Novick serves as Senior Advisor for the Andrea and Charles Bronfman Philanthropies, a private family foundation. From 1990 to 2004, Mr. Novick served as Chief Creative Officer of Grey Global Group, an advertising agency. Mr. Novick continues to serve as a consultant for Grey Global Group. He also serves asMr. Novick formerly was a member of the Board of Directorsdirector of Toll Brothers, Inc.

Steven Shulman was elected a director of the Company in December 2003. Since 2018, Mr. Shulman has been the managing director of Hampton Group, a company engaged in the business of making private investments. Mr. Shulman also serves as a director of various private companies and as a strategic advisor to Ancoris Capital Partners.

Vote Required

Directors are elected by a plurality of the votes cast by shareholders entitled to vote at the Meeting. Votes withheld and broker non-votes will not have any effect on this proposal.

THE BOARD OF DIRECTORS RECOMMENDS ATHAT SHAREHOLDERS VOTE “FOR” THE NOMINEES LISTED ABOVE AS STANDING FOR ELECTION AT THE MEETING, TO SERVE UNTIL THE ANNUAL MEETING OF EACH NAMED NOMINEE.OUR SHAREHOLDERS IN 2025, AS DESCRIBED ABOVE.

PROPOSAL No. 2:

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORSREGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has recommended, and the Board of Directors has approved, the appointment of Cohn,CohnReznick LLP (“Cohn”), an independent registered public accounting firm, to audit our financial statements for the 20212024 fiscal year. A representative of Cohn is expected to attend the Meeting and will have an opportunity to make a statement if he or she so desires. He or she will also be available to respond to appropriate questions from our shareholders. For additional information regarding our relationship with Cohn, please see the “Audit Committee Report” below.

Although it is not required to submit this proposal to the shareholders for approval, the Board believes it is desirable that an expression of shareholder opinion be solicited and, accordingly, presents the selection of the independent registered public accounting firm to the shareholders for ratification. If the selection of Cohn is not ratified by the shareholders, the Board of Directors will take that into consideration but does not intend to engage another firm. Even if the selection of Cohn is ratified by the shareholders, the Audit Committee in its discretion could decide to terminate the engagement of Cohn and engage another firm if the committee determines that this is necessary or desirable.

Vote Required

The affirmative vote of a majority of the votes cast by the shareholders entitled to vote on this proposal at the Meeting is required to ratify the appointment of Cohn. Abstentions and broker non-votes will not have any effect on this proposal.

THE BOARD RECOMMENDS THAT YOUSHAREHOLDERS VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF COHNREZNICK LLP AS INDEPENDENT AUDITORSOUR REGISTERED PUBLIC ACCOUNTING FIRM FOR THE COMPANY.

AUDIT COMMITTEE REPORT

The following report is not deemed to be “soliciting material” or to be “filed” with the SEC or subject to the SEC’s proxy rules or to the liabilities of Section 18 of the Exchange Act and the report shall not be deemed to be incorporated by reference into any prior or subsequent filing by the Company under the Securities Act of 1933 or the Exchange Act.

The Audit Committee evidenced its completion of and compliance with the duties and responsibilities set forth in the adopted Audit Committee Charter through a formal written report dated and executed as of December 21, 2020.19, 2023. A copy of that report is set forth below.

December 21, 202019, 2023

The Board of Directors

Ark Restaurants Corp.

Fellow Directors:

The primary purpose of the Audit Committee is to assist the Board of Directors in its general oversight of the Corporation’s financial reporting process. The Audit Committee conducted its oversight activities for Ark Restaurants Corp. and subsidiaries (“Ark”) in accordance with the duties and responsibilities outlined in the Audit Committee charter. The Audit Committee annually reviews the NASDAQ standard of independence for audit committees and its most recent review determined that the committee meets that standard.

Ark management is responsible for the preparation, consistency, integrity and fair presentation of the financial statements, accounting and financial reporting principles, systems of internal control, and procedures designed to ensure compliance with accounting standards, applicable laws, and regulations. The Corporation’s independent auditors, CohnReznick LLP, are responsible for performing an independent audit of the financial statements and expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the Unites States of America.

The Audit Committee, with the assistance and support of the Chief Financial Officer of Ark, has fulfilled its objectives, duties and responsibilities as stipulated in the audit committee charter and has provided adequate and appropriate independent oversight and monitoring of Ark’s systems of internal control for the fiscal year ended October 3, 2020.

These activities included, but were not limited to, the following significant accomplishments during the fiscal year ended October 3, 2020:September 30, 2023:

•Reviewed and discussed thewith management our audited financial statements as of and for the year ended September 30, 2023;

•Discussed with managementCohnReznick LLP, our independent registered public accounting firm, the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the external auditors.

SEC; and•Received and reviewed the written disclosures and the letter from the external auditorsCohnReznick LLP required by Independence Standards Board Standard No. 1,applicable requirements of the PCAOB regarding CohnReznick LLP's communications with the Audit Committee concerning independence, and discussed with the auditors theirCohnReznick LLP's independence.

In reliance on the Committee’s review and discussions of the matters referred to above, the Audit Committee recommends the audited financial statements referred to above be included in Ark’s Annual Report on Form 10-K for the fiscal year ended October 3, 2020,September 30, 2023, for filing with the Securities and Exchange Commission.

Respectfully submitted,

Ark Restaurants Corp. Audit Committee

Bruce R. Lewin, Arthur StainmanMarcia Allen and Marcia AllenJessica Kates

AUDIT FEES AND SERVICES

During fiscal 20192022 and 2020,2023, Cohn served as our independent auditors. The following table presents fees for professional audit services rendered by Cohn for the audit of our annual financial statements for the years ended October 1, 2022 and September 28, 2019 and October 3, 2020,30, 2023, and fees for other services rendered by Cohn during those periods.

| | | 2019 | | 2020 | | 2022 | | 2023 |

| | Audit Fees | Audit Fees | | $ | 282,250 | | $ | 292,250 | Audit Fees | | $ | 320,250 | | $ | 351,409 |

| Audit Related Fees | Audit Related Fees | | 35,250 | | 36,250 | Audit Related Fees | | 36,226 | | 42,000 |

| Tax Fees | Tax Fees | | - | | - | Tax Fees | | - | | - |

| All Other Fees | All Other Fees | | - | | - | All Other Fees | | - | | - |

| Total | Total | | $ | 317,500 | | | $ | 328,500 | Total | | $ | 356,476 | | | $ | 393,409 |

Audit Fees. Annual audit fees relate to services rendered in connection with the audit of our consolidated annual financial statements included in our Form 10-K and the quarterly reviews of financial statements included in our Forms 10-Q.

Audit Related Fees. Audit related services include fees for benefit plan audits and lease compliance audits.

Tax Fees. Tax services include fees for tax compliance, tax advice and tax planning.

All Other Fees: Includes other fees or expenses billed for other services not described above rendered to the Company by Cohn.

The Audit Committee considers whether the provision of these services is compatible with maintaining the auditor’s independence, and has determined such services for fiscal 20192022 and 20202023 were compatible.

We have been advised by Cohn that neither the firm, nor any member of the firm, has any financial interest, direct or indirect, in any capacity in the Company or its subsidiaries.

Policy on Audit Committee Pre-Approval of Audit and Non-Audit Services of Independent Auditor

The Audit Committee is responsible for appointing, setting compensation and overseeing the work of the independent auditor. The Audit Committee has established a policy regarding pre-approval of all audit and non-audit services provided by the independent auditor, as follows: on an ongoing basis, management communicates specific projects and categories of service for which the advance approval of the Audit Committee is requested, and the Audit Committee reviews these requests and advises management if the Committee approves the engagement of the independent auditor. On a periodic basis, management reports to the Audit Committee regarding the actual spending for such projects and services compared to the approved amounts. All audit-related fees, tax fees and all other fees were approved by the Audit Committee. The projects and categories of service are as follows:

Audit—Annual audit fees relate to services rendered in connection with the audit of our consolidated financial statements included in our Form 10-K and the quarterly reviews of financial statements included in our Forms 10-Q as well as fees for SEC registration services.

Audit Related Services—Audit related services include fees for benefit plan audits and lease compliance audits.

Tax—Tax services include fees for tax compliance, tax advice and tax planning.

All Other—Fees for all other services provided by Cohn.

EXECUTIVE COMPENSATION

The following table shows information concerning all compensation paid for services to the Company in all capacities during the fiscal years ended October 1, 2022 and September 28, 2019 and October 3, 2020,30, 2023, as to the Chief Executive Officer (its “principal executive officer” or “PEO”) and each of the other two most highly compensatedhighly-compensated executive officers of the Company who served in such capacity at the end of the last two fiscal years (the “Named Executive Officers” or “NEOs”):

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal

Position(s) | | Year | | Salary

($) | | Bonus

($) | | Option

Award

($) | | All Other

Compensation

($) | | Total

($) |

| Michael Weinstein | | 2020 | | $ | 726,664 | | | $ | 110,000 | | | $ | - | | | $ | - | | | $ | 836,664 | (1) |

| Chief Executive Officer | | 2019 | | $ | 1,054,156 | | | $ | 90,000 | | | $ | - | | | $ | - | | | $ | 1,144,156 | (1) |

| | | | | | | | | | | | | | | | | | | | | | |

| Vincent Pascal | | | | | | | | | | | | | | | | | | | | | | |

| Senior Vice President and | | 2020 | | $ | 351,962 | | | $ | 75,000 | | | $ | - | | | $ | - | | | $ | 426,962 | |

| Chief Operating Officer | | 2019 | | $ | 464,114 | | | $ | 65,000 | | | $ | - | | | $ | - | | | $ | 529,114 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Anthony J. Sirica | | 2020 | | $ | 351,505 | | | $ | 75,000 | | | $ | 50,319 | | | $ | - | | | $ | 476,824 | |

| Chief Financial Officer | | 2019 | | $ | 463,500 | | | $ | 65,000 | | | $ | - | | | $ | - | | | $ | 528,500 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Paul Gordon | | 2020 | | $ | 302,358 | | | $ | 75,000 | | | $ | 50,319 | | | $ | - | | | $ | 427,677 | |

| Senior Vice President | | 2019 | | $ | 397,376 | | | $ | 65,000 | | | $ | - | | | $ | 81,321 | (2) | | $ | 543,697 | |

____________________________________ | | | | | |

(1) | Section 162(m) of the Internal Revenue Code (“Section 162(m)”) disallows a tax deduction to a public corporation for compensation over $1,000,000 paid to certain executives. With respect to Mr. Weinstein’s compensation that is subject to the Section 162(m) deductibility limitations, the Compensation Committee used its judgment to authorize payments that do not comply with the exemptions in Section 162(m) as it believed that such payments were appropriate and in the best interests of the shareholders, after taking into consideration the executive’s individual performance and responsibilities. The Compensation Committee expects in the future to authorize compensation in excess of $1,000,000 to named executive officers that will not be deductible under Section 162(m) when it believes doing so is in the best interests of the Company and its shareholders. |

| |

(2) | 1% of operating profits of the Las Vegas operations as commissions. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal

Position(s) | | Year | | Salary

($) | | Bonus

($) | | Option

Award

($) | | All Other

Compensation

($) | | Total

($) |

| | | | | | | | | | | | | | | | | | | | | | |

| Michael Weinstein | | 2023 | | $ | 1,054,156 | | | $ | 150,000 | | | $ | - | | | $ | - | | | $ | 1,204,156 | |

| Chief Executive Officer | | 2022 | | $ | 1,054,156 | | | $ | 125,000 | | | $ | - | | | $ | - | | | $ | 1,179,156 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Vincent Pascal | | | | | | | | | | | | | | | | | | | | | | |

| Senior Vice President and | | 2023 | | $ | 487,320 | | | $ | 115,000 | | | $ | - | | | $ | - | | | $ | 602,320 | |

| Chief Operating Officer | | 2022 | | $ | 482,857 | | | $ | 100,000 | | | $ | - | | | $ | - | | | $ | 582,857 | |

| | | | | | | | | | | | | | | | | | | | | | |

Anthony J. Sirica (1) | | | | | | | | | | | | | | | | | | | | | | |

| President and Chief | | 2023 | | $ | 486,675 | | | $ | 115,000 | | | $ | - | | | $ | - | | | $ | 601,675 | |

| Financial Officer | | 2022 | | $ | 482,218 | | | $ | 100,000 | | | $ | - | | | $ | - | | | $ | 582,218 | |

12(1) Mr. Sirica has entered into a letter agreement with the Company, dated as of September 4, 2018 (the “Severance Letter”). Pursuant to the Severance Letter, and subject to the terms set forth, upon termination of employment in certain circumstances, Mr. Sirica will be entitled to receive the following benefits: (i) payment for accrued but unpaid benefits, (ii) lump sum payment equal to eighteen (18) months of total compensation, (iii) continuation of employee benefits and insurance coverage for eighteen (18) months, and (iv) vesting of all unvested and outstanding equity awards.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

The following table provides information on the holdings of stock options by the CEO and NEOs as of October 3, 2020:September 30, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Option Awards |

| (a) | | (b) | | (c) | | (e) | | (f) |

| Name | | Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable | | Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable | | Option

Exercise Price

($) | | Option

Expiration

Date |

| | | | | | | | | | | | | | |

| Michael Weinstein | | | 21,375 | | | | - | | | $ | 22.50 | | | 06/09/24 |

| Chief Executive Officer | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Vincent Pascal | | | 21,375 | | | | - | | | $ | 22.50 | | | 06/09/24 |

| Senior Vice President and | | | | | | | | | | | | | | |

| Chief Operating Officer | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Anthony J. Sirica | | | 20,000 | | | | - | | | $ | 22.30 | | | 09/04/28 |

| Chief Financial Officer | | | — | | | 15,000 | (1) | $ | 21.90 | | | 02/03/30 |

| | | | | | | | | | | | | | |

| Paul Gordon | | | 19,500 | | | | - | | | $ | 14.40 | | | 06/12/22 |

| Senior Vice President | | | 21,375 | | | | - | | | $ | 22.50 | | | 06/09/24 |

| | | — | | | 15,000 | (1) | $ | 21.90 | | | 02/03/30 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Option Awards |

| Name | | Grant Date | | Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable | | Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable | | Option

Exercise Price

($) | | Option

Expiration

Date |

| | | | | | | | | | | | | | | |

| Michael Weinstein | | 06/09/14 | | | 21,375 | | | | - | | | $ | 22.50 | | 06/09/24 |

| Chief Executive Officer | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Vincent Pascal | | 06/09/14 | | | 21,375 | | | | - | | | $ | 22.50 | | 06/09/24 |

| Senior Vice President and | | | | | | | | | | | | | | | |

| Chief Operating Officer | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Anthony J. Sirica | | 09/04/18 | | | 20,000 | | | | - | | | $ | 22.30 | | 09/04/28 |

| President and Chief Financial Officer | | 02/03/20 | | | 7,500 | | | 7,500 | (1) | $ | 21.90 | | 02/03/30 |

| | 11/14/20 | | | 3,750 | | | 3,750 | (2) | $ | 10.65 | | 11/19/30 |

__________________________________

| | | | | |

| (1) | These options vest as following:follows: (i) 50% on February 3, 2022 and (ii) 50% on February 3, 2024. |

| (2) | These options vest as follows: (i) 50% on November 19, 2022 and (ii) 50% on November 19, 2024. |

Item 402(v) Pay Versus Performance

In accordance with Item 402(v) of Regulation S-K, we are providing the following disclosure regarding executive compensation for our principal executive officer (“PEO”), and non-PEO named executive officers (“Non-PEO NEOs”) and Company performance for the fiscal years listed below. The Compensation Committee did not consider the pay versus performance disclosure below in making its pay decisions for any of the years shown.

The amounts set forth below under the headings “Compensation Actually Paid to PEO” and “Average Compensation Actually Paid to Non-PEO NEOs” have been calculated in a manner consistent with Item 402(v) of Regulation S-K. Use of the term “compensation actually paid” (“CAP”) is required by the SEC’s rules, and as a result of the calculation methodology required by the SEC, such amounts differ from compensation actually received by the individuals for the fiscal years listed below.

| | | | | | | | | | | | | | | | | | | | |

Year(1) | Summary Compensation Table Total for PEO(2) ($) | Compensation Actually Paid to PEO(2)(7)(8) ($) | Average Summary Compensation Table Total for Non- PEO NEOs(4) ($) | Average Compensation Actually Paid to Non-PEO NEOs(3)(4)(7)(8) ($) | Value of Initial Fixed $100 Investment based on Total Shareholder Return(5) ($) | Net Income (Loss) ($) (in millions) (6) |

| 2023 | 1,204,156 | 1,204,156 | 601,997 | 601,430 | 139.08 | | (5.4) |

| 2022 | 1,179,156 | 1,179,156 | 582,538 | 609,615 | 163.79 | | 10.2 |

| | | | | |

| (1) | We are a smaller reporting company pursuant to Rule 405 of the Securities Act, and as such, we are only required to include information for the past two fiscal years in this table. |

| |

| (2) | Our PEO reflected in these columns and for each of the applicable fiscal years is Michael Weinstein. |

| |

| (3) | In calculating the CAP amounts reflected in these columns, the fair value or change in fair value, as applicable, of the equity award adjustments included in such calculations were computed in accordance with Financial Accounting Standards Board Accounting Standards Update: Compensation Stock Compensation (Topic 718). |

| |

| (4) | Our Non-PEO NEOs reflected in these columns are Vincent Pascal and Anthony J. Sirica for both years presented. |

| |

| (5) | The Total Shareholder Return (“TSR”) reflected in this column for each applicable fiscal year is calculated based on a fixed investment of $100 through the end of the applicable fiscal year on the same cumulative basis as is used in Item 201(e) of Regulation S-K. |

| |

| (6) | The amounts reflected in this column represent the net income (loss) reflected in the Company’s audited financial statements for each applicable fiscal year. |

| |

| (7) | For fiscal year 2023, the CAP to the PEO and the average CAP to the Non-PEO NEOs reflect the following adjustments made to the total compensation amounts reported in the Summary Compensation Table for fiscal year 2023, computed in accordance with Item 402(v) of Regulation S-K. |

| | | | | | | | |

| PEO ($) | Non-PEO NEOs

(Average) ($) |

| Total Compensation Reported in 2023 Summary Compensation Table | 1,204,156 | | 601,997 | |

| Less: Grant Date Fair Value of Option Awards Reported in the 2023 Summary Compensation Table | — | | — | |

| Plus: Year-End Fair Value of Awards Granted in 2023 that are Outstanding and Unvested | — | | — | |

| Less: Year Over Year Change in Fair Value of Awards Granted in Prior Years that are Outstanding and Unvested (From Prior Year-End to Year-End) | — | | (567) | |

| Plus: Vesting Date Fair Value of Awards Granted in 2023 that Vested in 2023 | — | | — | |

| Plus: Year Over Year Change in Fair Value of Awards Granted in Prior Years that Vested in 2023 (From Prior Year-End to Vesting Date) | — | | — | |

| Less: Prior Year-End Fair Value of Awards Granted in Prior Years that Failed to Vest in 2023 | — | | — | |

| Plus: Dollar Value of Dividends or other Earnings Paid on Stock & Option Awards in 2023 prior to Vesting (if not reflected in the fair value of such award or included in Total Compensation for 2023) | — | | — | |

| Compensation Actually Paid for Fiscal Year 2023 | 1,204,156 | | 601,430 | |

| | | | | |

| (8) | For fiscal year 2022, the CAP to the PEO and the average CAP to the Non-PEO NEOs reflect the following adjustments made to the total compensation amounts reported in the Summary Compensation Table for fiscal year 2022, computed in accordance with Item 402(v) of Regulation S-K: |

| | | | | | | | |

| PEO ($) | Non-PEO NEOs

(Average) ($) |

| Total Compensation Reportable in Summary Compensation Table for 2022 | 1,179,156 | | 582,538 | |

| Less: Grant Date Fair Value of Option Awards Reportable in the 2022 Summary Compensation Table | — | | — | |

| Plus: Year-End Fair Value of Awards Granted in 2022 that are Outstanding and Unvested | — | | — | |

| Plus: Year Over Year Change in Fair Value of Awards Granted in Prior Years that are Outstanding and Unvested (From Prior Year-End to Year-End) | — | | 13,538 | |

| Plus: Vesting Date Fair Value of Awards Granted in 2022 that Vested in 2022 | — | | — | |

| Plus: Year Over Year Change in Fair Value of Awards Granted in Prior Years that Vested in 2022 (From Prior Year-End to Vesting Date) | — | | 13,539 | |

| Less: Prior Year-End Fair Value of Awards Granted in Prior Years that Failed to Vest in 2022 | — | | — | |

| Plus: Dollar Value of Dividends or other Earnings Paid on Stock & Option Awards in 2022 prior to Vesting (if not reflected in the fair value of such award or included in Total Compensation for 2022) | — | | — | |

| Compensation Actually Paid for Fiscal Year 2022 | 1,179,156 | | 609,615 | |

Pay versus Performance Comparative Disclosure

In accordance with Item 402(v) of Regulation S-K, we are providing the following descriptions of the relationships between the information presented in the table above.

Compensation Actually Paid and Company TSR

The following graph sets forth the relationship between CAP to our PEO, the average of CAP to our Non-PEO NEOs, and our cumulative TSR over the two most recently completed fiscal years.

Compensation Actually Paid and Net Income (Loss)

The following graph sets forth the relationship between CAP to our PEO, the average of CAP to our Non-PEO NEOs, and out net income (loss) over the two most recently completed fiscal years.

All information provided above under the “Item 402(v) Pay Versus Performance” heading will not be deemed to be incorporated by reference into any filing of the Company under the Securities Act, or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing, except to the extent the Company specifically incorporates such information by reference.

PROPOSAL No. 3:

NON-BINDING ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act, as well as the provisions of Section 14A of the Exchange Act, require that we provide our shareholders with the opportunity to vote to approve, on a non-binding advisory basis, the compensation of our named executive officers as disclosed in this proxy statement in accordance with the compensation disclosure rules of the SEC. We believe that it is appropriate to seek the views of shareholders on the design and effectiveness of the Company's executive compensation program.